Next Door Home Buying Programs®

Building Communities Through Homeownership™

What are the Next Door Programs®?

The Next Door Programs® (also known as Teacher Next Door) were designed to increase homeownership among teachers and other public servants, support community development, and increase access to affordable housing free from discrimination. The program is intended to eliminate confusion by streamlining the home loan and home buying process and by matching the individual with the best program available, based upon the specific needs of the program participant and their family. As a preferred Next Door Realtor, my community pledge is to rebate up to 25% of my TND commission toward my Buyer's allowable closing costs and prepaid items*.

*In accordance with RESPA and Federal guidelines

Ready to get started?

Scan QR code to attend Next Door's FREE, NO OBLIGATION HOME BUYER'S WEBINAR presented by TruView Lending.

OR

To start the program application process.

Contact Jill Hups, your Next Door Preferred Agent, at JillHups@kw.com |(720) 971-1766 if you have any questions.

Frequently Asked Questions

What programs are available?

What programs are available?

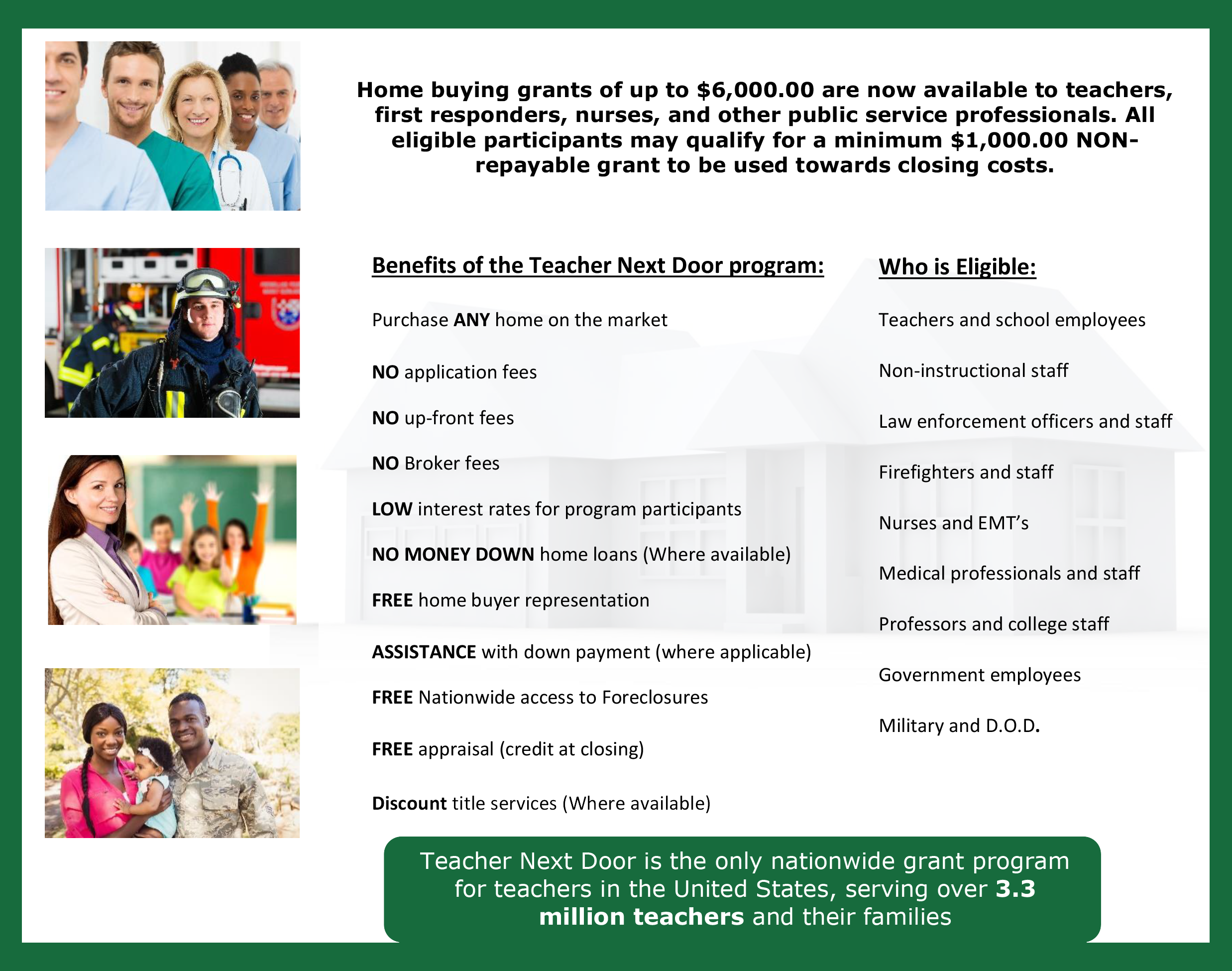

For home purchases, there are many different Federal, state and local programs available to Next Door Program® participants, including the HUD Good Neighbor Next Door Program, USDA Rural Program, and other specific programs available through HUD, FHA, VA, USDA, Fannie Mae and other local agencies. In addition, Teacher Next Door offers private money GRANTS and may be combined with our matrix of other nation and state-specific programs, such as Colorado FirstStep. Programs vary by city and state.

Do I need to use a Next Door Agent?

YES. Since our Agent Partners agree to contribute a portion of their commission towards your closing cost, to receive the full benefit of the Next Door Program®, you need to be exclusively represented by a Next Door® agent. Our Agent Partners are all highly trained, state-licensed professionals and members of the National Association of Realtors®. If you decide to use a non-Next Door® agent, you may not receive the agent rebate, as they are not required to contribute any of their commission.

Who is my Next Door® Agent?

Your Next Door® preferred agent partner is Jill Hups. You may reach her at JillHups@kw.com or (720) 971-1766 if you have any questions.

Do Grants have to be repaid?

NO. Grants available directly through Next Door® and the other programs we utilize, never have to be repaid. Grants are subject to availability.

NO. Grants available directly through Next Door® and the other programs we utilize, never have to be repaid. Grants are subject to availability.

Do you offer down payment assistance?

YES. In addition to our grant programs, we have down payment assistance of up to $10,681.00. These programs are available in all 50 states and may include, Home in Five Advantage, Home Plus, Georgia Dream, Golden State Platinum, Florida First, Military Heroes, First Home, Chenoa, and Unison, just to name a few. Your Teacher Next Door Program® Specialist is trained in all of the various programs and will explain your eligibility. Programs are each structured differently and eligibility varies by city and state.

What professions are included?

Next Door programs (also known as Teacher Next Door®) recently expanded the program to include many public service professionals. In addition to teachers, these include police officers, firefighters, nurses, medical professionals, government workers, and military. We are committed to serving those who serve us in the communities where we all live and work.

How do I purchase a home for a 50% discount off the list price?

This program is currently available to teachers, police officers, firefighters, and EMT's through HUD's Good Neighbor Next Door Program. These properties are located in certain revitalization areas and available via a lottery-style bid. There are some restrictions, including a three-year occupancy requirement. Contact Jill Hups, your preferred Next Door® agent, for additional details and to check availability in your area.

Are ALL homes through the Teacher Next Door® 50% off?

NO. Only the HUD "Good Neighbor Next Door®" homes.

Can I only buy certain homes?

NO. You may purchase ANY home on the market, in ANY neighborhood, as long as it is within the guidelines of your loan approval.

Is there an application fee?

NO. There is NEVER any application fee.

Are there any up-front fees?

NO. There are NEVER any up-front fees charged by Teacher Next Door® or our preferred lenders.

Is there a fee for using the Next Door Programs®?

NO. There is NO FEE at all for using the program. In fact, teachers, school employees, nurses or healthcare workers, law enforcement, firefighters, or government employees can expect to save money based upon lower fees charged for the various programs we offer. Plus, you may receive additional discounts on title insurance, home inspections, and other services.

Do I have to live in the home for a certain period of time?

NO. (Except for one or two down payment assistance programs that require a three or five-year commitment.)

Will you pull my credit?

NO. Teacher Next Door® will never pull your credit or have access to your personal financial information. When you apply and complete the short Pre-Application, you will be contacted by your Program Specialist who will go over the program with you, answer any questions, and discuss your options, including any GRANTS and down payment assistance you may be eligible for. Your credit would then be pulled during the mortgage application process.

What is the Simple Docs Program™?

With Next Door®’s new Simple Docs™ program, many times we can access all or most of your documentation online (with your permission), thereby eliminating the need for you to collect many of the loan documents typically required, including pay stubs, W-2’s, tax returns and bank statements. Simple Docs™ is not available in all areas. With each application, we only collect the documents required by law.

Is there a First Time Home Buyers Program?

YES. Our First Time Home Buyers Program allows buyers the unique opportunity to combine GRANTS and down payment assistance with the other programs we have available, including Fannie Mae's HomeReady, Freddie Mac's HomePossible, and HomeOne programs. Down payment assistance programs may include state-specific programs such as Arizona Home in Five, Georgia Dream, Florida First, and others or may include national programs such as Chenoa and Unison, depending on which has the greater benefit. To be eligible, you must be a teacher or school employee, nurse or healthcare worker, law enforcement, firefighter, or government employee.

Do I HAVE to be a First Time Home Buyer?

NO. If you own a home you may still take advantage of all Teacher Next Door® programs and benefits except for the HUD Good Neighbor Program, which prohibits you from owning any property for 3 years prior to placing a bid.

How does the Free Home Buyers Service Work?

Once approved, Jill Hups, your preferred Next Door® agent, will work with you to help find a home in your area. She will let you tour the inside of the homes, negotiate the purchase contract, and handle all of the paperwork for you.

Am I required to take a HUD First Time Home Buyers Class?

NO. You are NOT required to take a 4-hour or 8-hour HUD First Time Home Buyers class. Teacher Next Door® does not require any classroom home buyer counseling in order to utilize the program.

How do I know what program(s) I qualify for?

Your licensed Certified Program Specialist will help place you in the appropriate program and guide you through the process based upon your individual circumstance including credit, down payment (if any), and the location of property.

Can I buy with NO Money Down?

YES. But there are some restrictions for some of the zero-down programs. The most common of which is the area in which the home is located. If a zero-down loan is not available, the typical minimum out-of-pocket expense is approximately three to three and a half percent (3 – 3.5%) of the purchase price. This typically includes a down payment and other fees such as insurance, appraisal, etc. This may come in the form of a gift or 401(k) disbursement. Your Loan Officer can explain additional options.

Can I put more money down if I choose?

YES. You may put down any amount you like. If you put 20% or more down, you will typically be able to avoid PMI and you could qualify for a lower interest rate.

Are there any income restrictions?

NO. However, you must make enough to cover the payment. Also, some local down payment assistance programs may have a maximum income you may earn in order to qualify.

What if I own another Home?

No Problem. If you own a home you may still take advantage of all Teacher Next Door® programs and benefits except for the HUD Good Neighbor Program, which prohibits you from owning any property for 3 years prior to placing a bid.

What is the minimum loan amount?

What is the minimum loan amount?

We accept all applications, regardless of the loan amounts. Our Preferred Lenders are required to offer loans down to the individual state minimums, which in most cases is $10,001.00. However, lenders must also meet all other regulations and some lower loan amounts may not meet these regulations, due to individual borrower and loan characteristics.

What is the maximum loan amount?

There is no maximum loan amount. In many states, the maximum conforming loan amount is $647,200.00. This number is higher in other states. Our preferred lenders also offer Jumbo Loans. Please discuss specific loan amount questions with your Program Specialist.

Is Teacher Next Door® a Lender?

NO. Financing for the Teacher Next Door Program® is provided by our preferred direct lenders and select U.S. National Banks. Teacher Next Door® does not collect, store, or have access to your personal financial information and does not receive compensation from mortgage loan transactions. When you complete the online pre-application, you will be contacted by a licensed Program Specialist from our preferred lender who is knowledgeable in all of the programs available to you, including the Teacher Next Door Grant and various down payment assistance and other programs.

What will my interest rate be?

Since Teacher Next Door® is not a lender, we do not set interest rates. Our preferred lenders have agreed to provide you with an extremely competitive rate for your loan based upon your individual loan application and loan program. Your interest rate will be adjusted by the Federal underwriting guidelines based upon risk factors, as well as compensating factors.

What is a risk factor?

As with insurance, underwriter guidelines contain upward adjustments to the interest rate based upon risk factors. These may include: low credit score, high loan-to-value, first-time home buyer, no rental history, short time on the job, etc.

What is a compensation factor?

Whenever possible, underwriters use compensation factors to counter other risk factors to help keep the rate low. These may include, high credit score, long time on the job, recent college grad, good rental history, large down payment, etc.

Can I get a high-interest loan?

NO. Teacher Next Door®'s preferred lenders must adhere to Federal conforming guidelines. They do not offer sub-prime loans.

Is Teacher Next Door® a government agency?

Is Teacher Next Door® a government agency?

NO. The Teacher Next Door Program® is the largest National Home Buying Program in the United States, and administered by Teacher Next Door®, PLLC. (License No. FLCQ1044110) You may purchase any home on the market through the program, not just HUD-owned homes. It is an independent, private organization, licensed Real Estate Brokerage and registered with the U.S. Department of Housing and Urban Development to sell HUD homes and represent buyers in the purchase of HUD-owned homes. (HUD License No. NAID-TCHRNX832).

Ready to get started?

Or contact Jill Hups, your Next Door® Preferred Agent, at JillHups@kw.com | (720) 971-1766.